How many times did you say to yourself, “Kapit lang, malapit na sumahod,” even though you just received your paycheck the other day?

Admit it or not, times like these may be challenging and demotivating, especially when you live paycheck to paycheck.

But you are not alone! According to studies, 70% of the younger generation only makes enough money each week to make ends meet with their basic expenses.

Don’t lose hope because there are still things that you can do to overcome your dilemma about being “broke” by considering these factors.

1.Cut out unnecessary things in your budget

Online subscriptions? Weekly “deserve ko ito” moments? These things might be little compared to your other expenses, but they become more stressful when viewed in the larger picture.

In terms of an online subscription, you need to know what subscriptions are not suited to your lifestyle or schedule. There are instances wherein you do not even open the online application that you bought, yet you pay for it monthly or annually.

In short, if not needed, learn how to let go of it! Your budget for those unnecessary subscriptions may be allotted to more important things.

On the other hand, your weekly treat to yourself may also be a cause of your tight budget. Yes, you can treat yourself after stressful work, but remember that treating oneself does not need to be expensive.

Try to treat yourself to a good sleep or even a chill day at home, as this will not only get you away from the temptation of spending but can also let you explore more of yourself.

2. Always be practical

In budgeting your money, even deciding over food deliveries and cooking or packing lunch can affect your goal of having savings.

To start, always remember that the convenience of food deliveries is not the answer to your hunger dilemmas. Before clicking that confirm button, think of how much you can save if you just cook your own food.

If you’re going to work, consider having a packed lunch where you can choose whatever dish you like, unlike eating outside with limited choices.

Yes, there is nothing wrong with buying meals outside, but remember that it may be a small expense, but it will always be bigger when done on a daily basis.

3. Wise Mindset

When you’re financially burdened, it’s quite easy to focus on the negative aspects.

Although it won’t always be simple, having an optimistic mindset about money can be very beneficial.

You can do this by writing down all of your unwanted or constraining thoughts and beliefs. This will help you overcome the difficulty of cultivating a positive mindset. Consider how your financial practices may have been influenced by these ideas.

Once you have listed all of your negative thoughts regarding money, try to come up with a good concept to counter each one. Affirmations that are positive are the simplest approach to doing this.

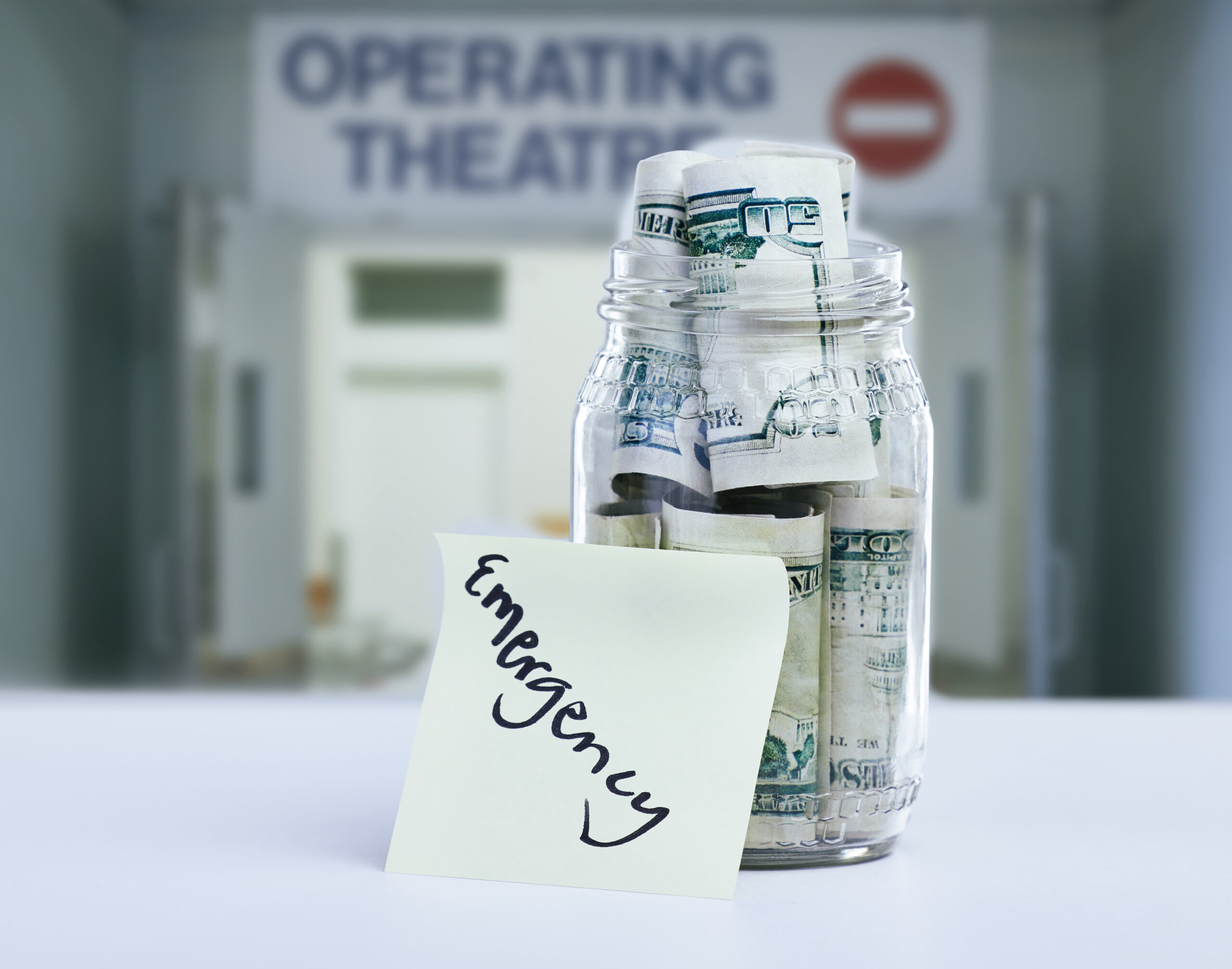

4. Emergency Budget

If you want to stop being broke, you need a fund for emergencies. You can start saving and setting money aside for situations once your budget has been put in place and your costs have been reduced.

Whether it’s an unanticipated illness or a serious accident, having an emergency fund can help you cover significant medical costs that would otherwise be financially burdensome.

Being prepared as well as having enough money “just in case” will help you feel more at ease when these kinds of situations occur.

5. Create Your Debt Management Plan

You’ve boosted your income, established a budget, and started an emergency fund. You can be more active in your debt repayment now that you have more breathing room in your financial situation.

Start by making a list of all of your debts along with the associated payments. From there, you are able to choose the repayment strategy that works best for you the most.

You can start making the list by arranging them by least and most interest when it comes to payment. With this, you will know what to prioritize over the others.

Also, remember that paying debts is not answerable by making another debt, so make sure that you allot financial room for this to avoid a cash burden.

Getting away in your “broke” era can be stressful, especially if that involves money. But small steps will always be a relevant way to have a better future.